04-12-2025

The HCP Engagement Funnel: How Qualitative Insights Drive Progress

Analytics are integral to the healthcare ecosystem. But for years, pharmaceutical companies have relied on quantitative, volume-based metrics such as email open rates, click-through rates, and attendance numbers to gauge performance.

While these quantitative data points provide a good baseline for reach, they do not capture the whole picture. These metrics are excellent at indicating an interaction occurred, but offer little insight into the value or impact of the interaction.

In This Article:

To drive meaningful growth, a shift from tracking purely quantitative metrics to qualitative metrics is required. This transition moves the measurement model from asking “How many HCPs did we reach?” to “How effectively did we engage with?”

Qualitative metrics are used to analyze the depth of the relationship. By analyzing factors such as the complexity of medical inquiries and the sentiment of feedback, companies can gain a clearer understanding of the HCP landscape.

This analytical shift is also key to moving along the HCP engagement funnel; quantitative data is sufficient to assess awareness (i.e., whether the product is a known name). However, awareness alone is not enough to drive product adoption. To move an HCP towards Advocacy, where they actively trust and recommend a specific product or therapy, teams must take into account these qualitative insights.

Defining HCP Engagement Funnel

To effectively apply qualitative insights, we need to define the stages of the HCP journey clearly. The framework detailed below maps the progression of an HCP from their initial interaction with a brand to becoming a trusted partner.

Top of Funnel (Awareness)

1. Objective: Broad Visibility & Education

2. The HCP Mindset: At this stage, the HCP may be unaware of your product/therapy. They are gathering general information at this stage.

3. Strategic Focus: The goal for teams here is to capture HCPs' attention and establish credibility. These efforts are designed to cast a wide net and bring HCPs into your ecosystem.

Middle of Funnel (Evaluation)

1. Objective: Deepening knowledge and Consideration.

2. The HCP Mindset: HCPs are now aware of your product/therapy and are actively assessing its clinical utility. They may also compare your product's safety and efficacy profiles against current standards of care.

3. Strategic Focus: This stage involves shifting from conveying general information to specific clinical evidence. Engagement here is to be judged by dwell time on data, participation in webinars, or downloading resources. Qualitative insights are critical here to determine which specific data points are of interest.

Bottom of Funnel (Adoption)

1. Objective: Trial and Clinical Application

2. The HCP Mindset: The HCP has evaluated the evidence and is ready to make a clinical decision. Pharma teams should, at this stage, offer practical support to facilitate adoption.

3. Strategic Focus: The conversation has shifted from utility to access. Resources that focus on practical applicability, such as dosage guidelines, should be prioritized.

Post-Funnel (Advocacy)

1. Objective: Loyalty and Peer Influence

2. The HCP Mindset: The HCP has successfully treated the patients with your device/therapy and trusts the outcome. They are willing to vouch for clinical adoption to their peers.

3. Strategic Focus: This is the most valued stage. Teams engage these HCPs for speaking opportunities and peer-to-peer education. The relationship transitions to a collaborative partnership here.

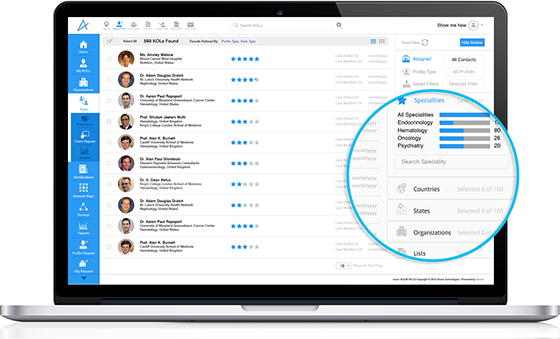

konectar: Precision in Engagement

konectar offers intelligent analytics that help transform raw data into strategic foresight.

Scientific Share of Voice (SSoV)

Unlike traditional share of voice, which measures only advertising volume, SSoV measures the dominance of your scientific narrative within the medical community. It tracks the frequency and impact of your specific device/therapy across publications, presentations, and clinical guidelines, compared with your competitors.

This is a crucial metric for gauging awareness (TOFU) and evaluation (MOFU) stages. konectar SSoV reports help you analyze whether your abstracts (from scientific papers or journals) are being cited by peers or discussed in key sessions.

Institutional Heatmaps

konectar can help visualize geospatial data to identify “Centers of Excellence” (CoEs). CoEs are high-value institutions based on clinical trial activity, funding, patient volume, etc.

This analysis supports resource allocation and territory mapping, rather than deploying your limited team members across a region. Heatmaps allow for targeted deployment to institutions with the highest potential for Adoption (BOFU).

KOL & Speaker Intelligence

konectar Analytics reports offer much more than static biographies, going beyond them to dynamic influence mapping. It analyzes an expert’s digital footprint, their peer network, and speaking history to determine not just who they are but how they influence others.

This type of analysis is essential to identify potential Advocates (Post-Funnel). konectar also offers detailed profiles of “Rising Stars”, emerging figures that are yet to be known but are already publishing high-impact data. Engaging these individuals early can lay the foundation for a loyal advocacy relationship before competitors engage them.

Making Analytics Work For You

By shifting focus from mere attendance to qualitative metrics (analyzing sentiment, behaviour, scientific share of voice), teams can transform raw data points into strategic assets.

Leverage konectar Analytics Reports to your advantage and measure the lasting impact of your scientific narrative to optimize your future strategy. Book a demo today to get started with konectar.